Products

Learn from me and other "Subject To" experts

When you join "Serious Subject To" community you get access to me, Jeff Watson. Also a supportive community that will help you learn how to do "Subject To" deals faster and more securely when you implement the insiders strategies, tips and tactics shared inside our community.

You'll also learn how I:

Have been able to secure great deals as an investor

Help real estate investors protect themselves against lawsuits, audits and paying excessive taxes

Have consistently helped investors do better deals by the things I teach and the tools I offer

Introducing

The Serious Subject To System

Step 1: Finding the Deal

Step 2: Negotiating and Structuring the Deal

Step 3: Papering the Deal

Subject-to real estate transactions, when properly done, can change not only your life and the balance sheet of your business, but they can spare sellers/homeowners from difficult, painful decisions involving whether or not to let a house go to foreclosure or stay trapped in a house they can no longer afford.

Imagine the immense satisfaction you will feel when you do good by a seller and make money for yourself and your family. I am being serious about this!

The key is learning how to do subject-to transactions correctly so that you solve problems instead of creating more problems due to inexperience or ignorance. It is no longer amateur hour in this real estate market.

This market will no longer forgive ignorance or newbie mistakes. It is radically different from the market of the early 2000's. We are not repeating the housing crash of 2008.

One of the biggest differences from 2008 till now is the number of state-by-state regulatory changes protecting homeowners, particularly those who are in default or foreclosure.

Warning!

Did you know that it may be illegal in many states to market to individuals or offer to take over their houses when they are behind on their payments?

Neither Jeffery S. Watson nor anyone with WatsonInvested.education or SeriousSubjectTo.com are CPAs, nor have they ever played one on TV. You need to verify anything and everything on this website using someone you trust and who claims to be a competent tax, business, investment or legal professional of your choosing. Remember, you are 100% responsible for your decisions and actions! All material on this website is for classroom instruction only. It is here to cause you to think, to use your imagination, to ask questions and debate topics. Documentation appropriate in one state WILL NOT be appropriate in another state. A creative deal structuring and/or funding technique suitable for one transaction is not suitable for most other transactions. Warning: Those of us at WatsonInvested.education and SeriousSubjectTo.com fail miserably at being politically correct. If your feelings are easily hurt, if you are offended by small things, if you often feel the need to retreat to a safe place, if you regularly need hugs to comfort you, then you’ve come to the wrong website. You should leave immediately, if not sooner! There, you have been advised!

...some of the subject-to promoters out there on the internet are not completely on the up and up or up to date on the law and regulatory landscape involving loan modifications, sale and lease back arrangements and subject-to acquisitions, therefore following their advice and tactics could have serious negative consequences...

Until now, no one has been taking these issues seriously.

That's why I am on a mission. The mission is to educate and help investors do sub-to transactions correctly. I have spent over 10 years and tens of thousands of dollars lobbying in DC on behalf of the real estate investing industry.

We finally have a seat at the Housing Policy table. All of that could be lost due to bad publicity from subject-to deals done the wrong way.

I call what I am offering you, "Serious Subject To" education and training.

Serious about doing Subject-to deals the right way?

If you are the type of investor who wants to help sellers with their problem properties, make serious money for yourself, and legally stick it to the IRS, then you are in the right place.

Don't let this overwhelm you. Let me help you.

Doing Subject To Real Estate deals does not need to be scary and it doesn't need to be complicated. It is all about finding the right deal, structuring it in a way that is clear to the seller, and documented with the correct easy to use paperwork so that it is clear to the IRS to prevent unnecessary taxation while avoiding seller amnesia and other potential legal blow back.

The "Serious Subject To" All-In Package does just that... and more.

Step 1: Finding the Deal

It starts with finding the right deal.

Many times these deals come to investors based upon relationships that they have with friends and acquaintance. Remember in some states it could be potentially a bad idea to use direct marketing techniques to people who are behind on their house payments.

It is important for you to know how to talk to people. There are three simple questions to ask:

1. Why would you want to sell a nice house like this?

2. What are your immediate cash needs?

3. Would you be interested in a tax strategy offer?

After you ask each of these questions. keep your mouth shut and listen with both ears and your eyes.

A follow up question "tell me more about that reason" is always a good idea.

Step 2: Negotiating & Structuring the Deal

Based upon the seller's answers to the questions in Step 1, you will know if you can buy the house Subject To.

In the videos within the course we talk about two key criteria in negotiating and structuring the deal:

the importance of a minimum monthly cash flow. If the house will not rent for at least a minimum acceptable profit over and above the current monthly payments, then it is not a good deal for a Sub-To rental.how to fill out the purchase agreement based upon the seller's specific loan information.

the importance of a minimum monthly cash flow. If the house will not rent for at least a minimum acceptable profit over and above the current monthly payments, then it is not a good deal for a SubjecTo rental.

How to fill out the purchase agreement based upon the seller's specific loan information.

Step 3: Papering the Deal

Clarity is crucial! Having paperwork properly filled out that covers all the material aspects and most of the foreseeable details is crucial for a successful deal.

Your paperwork needs to be easy to fill out, understandable by the seller, close all potential loopholes, while giving you the protection you need to stand up against IRS scrutiny or aggressive attorneys.

I can't begin to tell you all the horror stories of seller confusion or amnesia two, three years after the sub-to deal was closed. You can prevent the seller from coming back and saying "you told me that you were going to payoff my mortgage", "you said such and such", or "my lawyer said you took advantage of me."

All of this is preventable with clear carefully drafted paperwork.

How can you do this?

Presenting A Proven Step by Step System To Get You Started Right in Acquiring Your First or Your Next "Subject-To" Real Estate Deal.

The "Serious Subject To" All-In Package

Digitally delivered class, Access it anytime on any device 24/7.

Step by Step process. Simply follow along one step at a time.

Perfect whether you are starting out or already have some experience.

Here is what you get...

1. "Subject To" Document Library

Documents & Explainer Videos

The "Sub To" Document Library is my proven set of legal documents that will help you you even if you are just starting out.

It's an extensive online training masterclass that takes you by the hand and shows you and your legal team exactly how to use these documents to structure your deals.

You can pay another lawyer tens of thousands of dollars to start from scratch and hope they get it right. Or, you can get these "battle-tested" legal documents today.

Grab this extensive All-in package so that you can start using these documents with your legal team to structure your next deal.

What is included?

Module 1: Acquire

Forms related to acquiring property

ADDENDUM TO CONTRACT FOR SALE AND PURCHASE

ADDITIONAL ACKNOWLEDGEMENTS OF SELLER AT CLOSING

AGREEMENT TO PURCHASE REAL ESTATE SUBJECT TO EXISTING MORTGAGE

ASSIGNMENT OF MORTGAGE ESCROW ACCOUNT

AUTHORIZATION FOR RELEASE OF RECORDS

CLOSING INSTRUCTIONS FOR ACQUISITION

DECLARATION OF TRUST AND TITLE HOLDING TRUST AGREEMENT

DTI INSTRUCTION LETTER

DUE-ON-SALE ACKNOWLEDGEMENT

DURABLE LIMITED POWER OF ATTORNEY FOR PROPERTY, MORTGAGE AND INSURANCE

WARRANTY DEED TO TRUSTEE

MEMORANDUM OF TRUST

Module 2: Finance

Forms related to financing property

COMMERCIAL PROMISSORY NOTE, IRA LOANS, 2nd lien for arrearages

COMMERCIAL PROMISSORY NOTE, IRA LOANS, 3rd lien for seller finance portion

COMMERCIAL PROFIT PARTICIPATION PROMISSORY NOTE, IRA LOANS, 2nd lien

DEED OF TRUST private lender second

DEED OF TRUST seller subordination

MORTGAGE, Private Money second

MORTGAGE, Seller-Finance Subordinate

Module 3: Sell

Forms related to the sale of property

ACKNOWLEDGEMENT Due on Sale in Land Contract

CLOSING INSTRUCTIONS FOR DISPOSITION

DTI Instruction Letter

WRAP ALL-INCLUSIVE PROMISSORY NOTE

MORTGAGE, Private Money second

Module 4: ROTH & Subject To's

2. Taxation and Structuring "Sub To" & Wraps

In these videos, John and I deliver common sense, practical training and wisdom on not only what the tax law is, but how to adjust your business to achieve the desired result of avoiding phantom income tax when you are buying property from a burned-out landlord, maximizing your long-term capital gains, structuring installment sales, and having information to help you negotiate a better deal with your seller and buyer.

We also break down in detail what it means to be a dealer and the tax significance of that versus being a long-term capital gains investor.

All this information is in a format that you can share with your tax preparer or accountant to help you educate them.

These videos alone are worth much more than the price of this course.

What do these videos include?

Module 1: Laying the Foundations

Lesson 1 - Introductions & Why You Should Listen to Us

Lesson 2 - Foundational Concepts

Lesson 3 - Installment Sales Treatment

Lesson 4 - Capital Gains Overview

Lesson 5 - Deed vs Deed of Trust vs Mortgage vs Promissory Note

Lesson 6 - Default vs default "Due on Sale"

Lesson 7 - Sub2 & Wrap Defined

Lesson 8 - Case Law: Webb, Voight, Goodman

Lesson 9 - Summary

Module 2: Installment Sales

Lesson 1: Why It Matters

Lesson 2: Walk through

Lesson 3: Downside

Lesson 4: Summary

Module 3: Installment Sales

Lesson 1 - Disclosures and regulators

Lesson 2 - Trusts: Reality vs Fantasy

Lesson 3 - Depreciation recapture, Dealer status and Selling considerations

3. Papering Up a "Sub-to" Deal

In this three part video series, I walk a friend through the process of using the Acquire documents to create the necessary paperwork and documentation to secure his "Subject-To" deal.

The "Sub To" Overview and Walk Through videos are powerful in themselves. Seeing them implemented in a real life example walking through the use of these documents will take your knowledge to a whole new level.

Lesson 1 - Disclosures and regulators

Lesson 2 - Trusts: Reality vs Fantasy

Lesson 3 - Depreciation recapture, Dealer status and Selling considerations

4: Q&A Session for Taxation and Structuring "Sub To" & Wraps

This session is jammed packed with golden nuggets for serious sub-to investors regarding tax and legal implications.

This video features John Hyre and me answering questions about our premiere Taxation and Structuring Sub To & Wraps

course.

When we opened up that other course for an early BETA preview, we were surprised to find that one-third of the people who snatched it up were either attorneys, accountants or real estate coaches. We knew we hit gold as they told us that no one is teaching the things John and I teach in this course and investors absolutely need to know this stuff.

Listen and learn from what these experienced and newbie investors were asking John and me about. This will prime the pump for what you need to be thinking about in becoming a serious sub-to investor.

5. Using Title Holding Trusts in Subject-To Transactions

A detailed training on using trusts in Subject-To transactions, such as trustee and beneficiary selection. The powerful advantages of using a trust to buy "subject to" are explained in detail.

The current economic conditions provides an opportunity to leverage this strategy.

PUT THE "SERIOUS SUB-TO" ALL-IN PACKAGE

TO WORK TODAY!

Here is a recap of Everything you are going to get.

"Sub To" Document Library - Documents

($25,000 value)

"Sub To" Document Library - Explainer Videos

($1,825 value)

Taxation and Structuring Sub To & Wraps

($2,250 value)

Papering Up a "Sub-to" Deal with John Cochran - 3 part series

($1,750 value)

Taxation and Structuring Sub To & Wraps - Q&A Session

($545 value)

Using Title Holding Trusts in Subject-To Transactions

($500 value)

That's OVER $31,870 of REAL Value you are getting right now!

As soon as you enroll you'll get instant access to the "Serious Subject To" training portal.

Order through our safe and secure order page & receive your username and password.

Get instant access and get started right away.

Digitally delivered class, login to access the training, take the class online or download the lessons and consume it on the go!

* Instant Digital Delivery

Note: Digital Access Only - Not a physical product

Some Love From Our Customers

And It Gets Better Because You'll Also Get Over $1,100 Worth Of Special BONUSES!

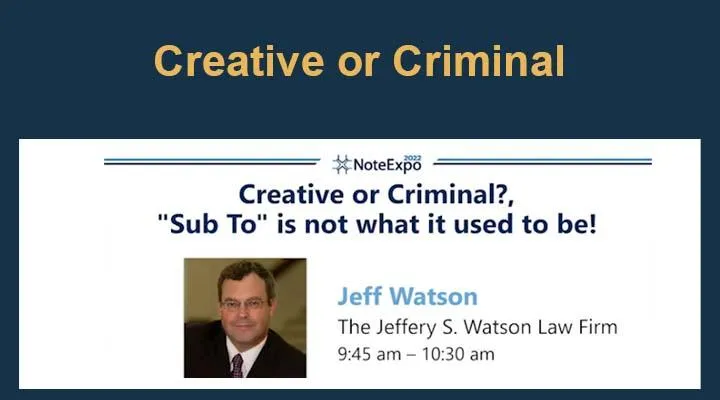

Bonus #1: Creative or Criminal ($500 Value)

Six major problems to avoid when structuring your Subject-To real estate deals.

This is recent speech given by Jeff to a national audience regarding subject to transactions, various problems with them, and how to overcome those problems. Including:

The 3 worst sources of legal advice for real estate investors.

Sub-To problems you must avoid.

Bonus #2: How to Do Your First Few "Subject To" Real Estate Deals Without Fear of making Newbie Mistake, dealing with Sellers Remorse and owing too much in taxes to the IRS. ($345 Value)

This video shares the necessary steps to structure a deal using the "Subject-To" technique and what you need to know to protect yourself from bad deals, unwanted lawsuits and unnecessary taxation by the IRS, or worse.

Bonus #3 Three Power Questions to ask Sellers to Begin the Conversation about a "subject-to" purchase. ($300 Value)

This video shares the details of Step 1: Finding the Deal, presenting the questions you need to ask sellers to determine if "subject-to" is a viable solution.

More Bonuses to Come!

What is the investment to get access?

That's a good question.

You could also try to figure all this out on your own, spending thousands upon thousands of dollars and still not have the protection and peace of mind you deserve.

This class is not going to be $31,870 dollars, which you know is what it would cost to hire me directly at my current hourly rate.

This class is equal to that if not more valuable but it is way more affordable.

This class is not going to be $14,997 dollars

Not even $9,997...

When you take action today you can get "All-In" instant access to everything for $4,197

But wait...there's more

You also get "Serious Sub To" Community

Introducing the secret for getting serious about "Subject To" investing and how I, Jeff Watson, will help you to do it right.

Join a Community and Learn a Proven System To Get You Started Right in Acquiring Your First or Your Next "Subject-To" Real Estate Deal.

Get Instant access to additional training, coaching and exclusive "Serious Sub To" community with other members that will help you on your journey to becoming a Serious Sub To investor.

What you'll get

Instant access to high-value training

You will get instant access to our archive of training sessions. Then each month you will be invited to attend a live training session.

Each of these hour-long training sessions is packed with valuable and actionable content that you can apply to your "subject to" real estate investing efforts.

I reserve the right to include additional unannounced training to thrill and delight you. We are serious about your success.

Live Group Coaching Streaming Sessions

Each month we also conduct a live group Q&A session. You can attend and ask questions live. The best part is, if you can't make these calls live, simply submit your questions in advance. Every call is recorded so if you can't make it you'll always have the recordings available.

This is your opportunity to ask your specific questions regarding "subject to" investing.

BONUS - If you prefer reading or listening to information rather than watching videos, you'll be happy to learn that all calls are transcribed and are also available via audio.

Help & Support from a private community

Our Community Forum is a place to interact with other like-minded folks, share successes, post to your progress journal, and get feedback or pose questions as you learn and grow alongside others.

Keep in mind this is an educational forum. This is not a place to seek free legal advice. You will need to seek out a competent and knowledgeable attorney for that.

You get One Year of Community access when you purchase.

So here's what you want to do next

Click on the Button below right now

When you do you'll reach the safe and secure order page.

Simply add your information. Then click the "Complete My Order" button.

You will then immediately reach the thank you page with important information for you to review.

You will also receive an email from

<news.m2064@mbrmail.com> with all of your login details.

After you login, you will have access to the Serious Subject To All-In Package resources along with all of your bonuses.

READY TO GET ACCESS?

All-In Bundle

Taxation and Structuring Sub To & Wraps (Hyre & Watson)

+ Expanded "Sub To" Document Library (Modules 1-4: Acquire, Finance, Sell, ROTH)

+ Papering Up a "Sub to" Deal

+ Bonus Material

+ One year of Community

$4,197

_

Advanced Bundle

+ Expanded "Sub To" Document Library (Modules 1-3: Acquire, Finance, Sell)

+ Papering Up a "Sub to" Deal wit

+ Bonus Material

+ One year of Community

$3,297

_

Starter Bundle

+ Expanded "Sub To" Document Library (Modules 1: Acquire)

+ Papering Up a "Sub to" Deal

+ Bonus Material

+ One year of Community

$1,597

_

Note: When you click on a button above you will be redirected to our watsoninvested.education site to order.

What is Included

ALL-IN

ADVANCED

STARTER

"Sub To" Documents Library (Module 1: Acquire) - Documents & Explainer Videos

"Sub To" Documents Library (Module 2: Finance) - Documents & Explainer Videos

"Sub To" Documents Library (Module 3: Sell) - Documents & Explainer Videos

"Sub To" Documents Library (Module 4: ROTH) - Documents & Explainer Videos

Taxation and Structuring "Sub To" & Wraps with John Hyre

Papering Up a "Subject To" deal - 3 Part Series

Q&A Session for Taxation and Structuring "Sub To" & Wraps

Using Title Holding Trusts in "Subject To" Transactions

Bonus #1: Creative or Criminal

Bonus #2: How to Do Your First Few "Subject To" Real Estate Deals without Fear of Making Newbie Mistakes

Bonus #3: Three Powerful Questions to Ask Sellers to Begin the Conversation About a "Subject To" Purchase

Roth IRAs and "Subject To" deals: 3 Different. Ways to do "Subject To" Tax Free - Parts 1 & 2

FAQ

Will this help me structure better deals when buying from burned-out landlords?

Yes, it will teach you how to help them avoid experiencing phantom income tax.

Will this teach me what I need to know to avoid being tagged as a dealer if I sell the houses I buy subject-to?

Yes, this course will give you step-by-step strategies on how to prevent being identified as a dealer by the IRS and being taxed accordingly.

Are the documents that are included good for use in all 50 states?

The documents included are usable in nearly every state, but you will always need to have your own local attorney review them to make sure they are fine tuned for your particular state and county.

How much experience do John and Jeff really have as real estate investors?

John and Jeff are both real estate investors themselves and have represented hundreds of investors over the last couple decades. They draw upon their experiences in Tax Court and other courts, appearances before regulatory bodies, meetings with members of Congress, and their own transaction knowledge and experience. Jeff began doing subject-to transactions more than 20 years ago and still has some of the closed files in storage to prove it!

How do I know that the tax information from John is accurate?

John makes a living representing real estate investors before the IRS. His track record is impeccable. He is considered by many to be the go-to guy when an IRS audit goes poorly.

© Copyright 2024. WatsonInvested LLC. All rights reserved.